Mar 16, 2021

6 minute read

Topic

Leadership

Introduction - Companies diversify their outputs to gain a strategic edge, why not the inputs?

Diversity and inclusion have been much talked about in the last few years. More than mere buzz words, they increasingly became a focus for companies. With the purpose of tackling socio-economic and opportunity inequalities issues, there has been mounting pressure on companies to have their workforce and leadership be more representative of their clients’ demographics and the available workforce where they operate. The endeavor is driven by internal and external stakeholders, investors, legislation, and policies.

Indubitably, diversity in the workplace is hard to implement, especially when we fail to see its value and there are obvious challenges in the way. For instance, we all have our biases that tend to be confirmed within our own social circles. This situation can make us think of Pierre Bourdieu’s theory of habitus1, which states that a system of dispositions, acquired schemes of perception, thought and action is developed by individuals through their engagement with other fields operating in their social world. However, drawing a parallel with portfolio diversification can help us understand that diversity adds value when implemented properly.

Diversity in the workplace can be along the dimensions of race, ethnicity, gender, sexual orientation, socio-economic status, age, culture, thought, abilities and disabilities, religious beliefs, political beliefs, or other ideologies. In the same vein, diversification in finance involves investing in a range of assets with differing features in order to reduce residual risk2. In the corporate world, diversification is a strategy in which a company acquires or establishes a business other than that of its current product. In both finance and the corporate world, the process of reducing exposure to any one particular asset or risk is seen as beneficial or valuable.

Most people positively see value in diversifying the firms’ outputs, e.g., the strategies, the products, the revenue streams. With human capital3 being a key input for companies, it should be only fair to assume there is value in diversifying that input. Diversity and diversification have more in common than their Latin root; they both carry value.

Dispelling the urban myth of a lack of diverse talent, again!

“There is a very limited pool of [minority] talent to recruit from […]” encapsulates the archetypical excuse to justify a lack of diversity in leadership roles. Yes, we could easily agree that implementing diversity is a challenge. It is difficult to do, even more so as our natural tendency is to recruit within our own overlapping circles. Consciously stepping out of our comfort zone and searching for fitting candidates is essential to successfully achieve diversity goals.

In a similar fashion, managing a portfolio in finance is no less of a daunting task; faced with the challenge of producing better risk-adjusted returns, portfolio managers are logically compelled to reduce the risk for a given amount of return. Diversify they must!

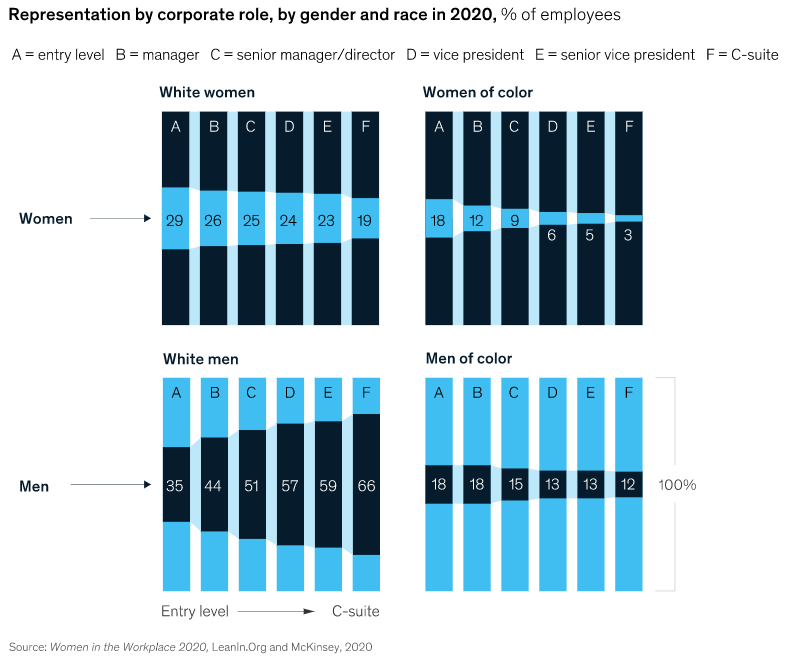

There is growing diversity in America. In 2019, almost 40% of people identified as racial or ethnic minorities. African Americans comprised 12.2% of the U.S. population, Hispanic and Latino Americans 18.5%, and Asian 5.6%, totaling 36.3% of the population4. Although, we see a reasonably equal representation in entry-level roles (see Exhibit 1), the proportions of women and minorities dwindle away as they move upward the corporate ladder.

Exhibit 1

Diversification benefits are well comprehended by investors and corporate leaders when it comes to the business or the sources of revenues. Portfolio managers are constantly looking for ways to diversify and gain an edge. They are incentivized to find and research new types of assets (alternatives, REITS5, cryptocurrencies, SPACs6). They learn to understand how to integrate those assets into their portfolio strategies. Ultimately, they are compensated to solve those types of challenges, which in turn fuels innovation in the financial industry.

Nevertheless, putting human capital through the diversification lens has been unsatisfactorily slow. Like portfolio managers, corporate leaders must essentially be incentivized to implement workplace diversity. For example, leaders must recognize that achieving diversity goals helps reduce operational risk within the company. Moreover, with human capital having its fingerprints across all operations, companies want to avoid the cost or losses due to employee dissatisfaction, attrition, homogeneity of thought, lack of fresh ideas, and the failure to attract and retain the best talents.

The diverse talent exists and is abundant. Accessing the pool requires a combination of proactive networking and recruiting out of our own circles, defining search outcomes to include diverse talents, and building a pipeline of curated talents.

The business case for diversity gets stronger with time.

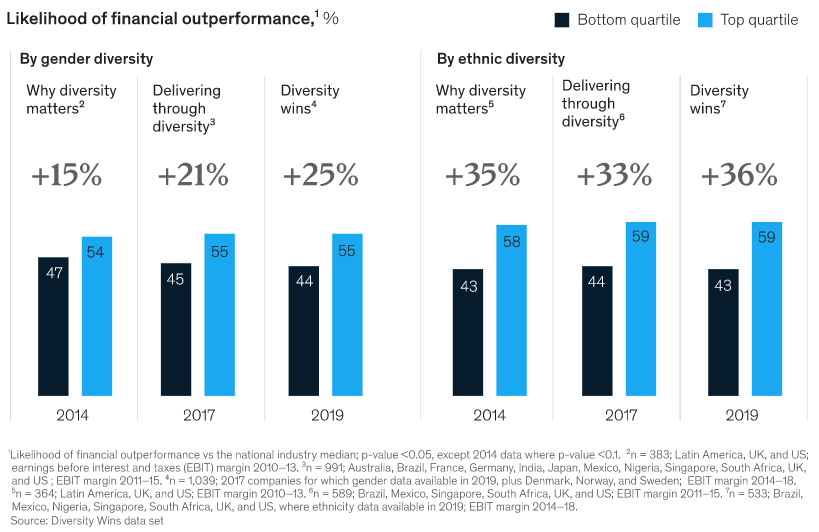

Research makes it increasingly clear that companies with more diverse workforces tend to perform better financially. Through a trilogy of reports over the last five years, Why Diversity Matters (2015), Delivering Through Diversity (2018) and Diversity Wins (2020), McKinsey shows that the business case for diversity grows stronger over time (see Exhibit 2). Companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile, up from 21% in 2017 and 15% in 2014. The gap is widening between fast movers and slow movers in that department.

Challenging and jousting the status quo.

A company's ability to create value, hold financial sustainability, remain relevant and grow cannot be achieved without maintaining sustainable human capital practices. Part of it involves recognizing diversity as a positive contributor.

Although companies unquestionably report to their shareholders, they also cater to customers; they work with suppliers and they operate within communities. Recognizing that human capital is source of ideas, intellect, knowledge, perspective, and culture, that capital can be powerfully enriched by diversity. Furthermore, diversity helps alleviate the misunderstandings and bias risks in the regular interactions of the companies with all its stakeholders.

Clinging to the status quo and not evolving is antithetic of any progress or innovation, and those two are critical for any organization’s survival and sustainable growth.

Exhibit 2

How can this be done?

Scores of studies and surveys have already extensively covered the topic. While this looks like a massive undertaking, the good news is that a small start can have a positively contagious impact and initiate systemic progress. A strategy aiming at promoting to leadership positions a handful of strong performing minority executives will create role models and will, predictably, result in more diversity in the recruiting pipelines and in the lower employee ranks over time. A new habitus will take form and with time we will no longer be talking of diverse talent, but simply of talent.

Of course, inclusion must be an integral part of the diversity goals. Indeed, to be effective, the individuals constituting the workforce must feel that they belong, and see that meritocracy is a uniform standard, not a double standard. Otherwise, without inclusion, workplace diversity at any organization is only ephemeral.

Conclusion – Human capital is capital too; diversification may be helpful.

Diversity, when implemented well, can be rewarding, just like portfolio diversification can be. If we overcome our tendency to only look within our social bubbles and our biases, the undertaking is well worth the effort.

The good news is that solutions are constantly being explored to undertake those challenges. Certainly, an avenue to address the lack of diversity is to encourage individuals to venture outside of their circles of comfort; furthermore, firms and organizations should vie for making unconscious bias training a mandatory part of the Human Resource corporate training curriculum. This would, at least, support individual growth within our professional and social environments.

Since human capital is a key force driving any business, it is only fitting that it too enjoys the benefits of diversification like any type of capital. Progress has been slow on that front so far; this will accelerate only when the leadership teams start seeing the material value of diversity. That value is not just limited to finding more talents to contribute to the success of an organization; diversity also creates invaluable intangibles, such as a healthy culture that benefits all firm-wide, boosts the teams’ morale, promotes authenticity, and makes organizations more resilient in times of crisis.

Finally, investors and shareholders can benefit from more resilience, as this inherently mitigates the risk of loss of value. In addition, they can gain from accrued productivity in the organizations as diverse inputs will fuel productivity and innovation.

Footnotes

1 Pierre Bourdieu (1930-2002) was a French sociologist, anthropologist, philosopher, and public intellectual. Bourdieu's major contributions to the sociology of education, the theory of sociology, and sociology of aesthetics have achieved wide influence in several related academic fields, popular culture, and the arts.

2 Also known as unsystematic risk, or specific risk, it is associated with a particular investment such as a company's stock. It can be mitigated through diversification, and so is also known as diversifiable risk. Once diversified, investors are still subject to systematic risk – also known as non-diversifiable risk - inherent to market-wide exposure.

3 Human capital is commonly used to describe the skills, knowledge and abilities employees bring to their jobs.

4 Source : https://www.visualcapitalist.com/visualizing-u-s-population-by-race/

5 Real Estate Investment Trusts

6 Special Purpose Acquisition Companies

DISCLOSURES

© 2021 V-Square Quantitative Management LLC. All rights reserved

This material is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation, or recommendation with respect to any investment service or product provided by V-Square. Furthermore, the information contained here should not be treated as legal, investment, or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific advice from their own professional legal or tax advisors.

Any reference to a specific security, investment, or index is for illustrative purposes only, and it is not intended and should not be interpreted as a recommendation to purchase or sell such security, investment, or index. The trends discussed in this paper should not be considered recommendations for action by investors. They may not be representative of V-Square’s current or future investments.

This information contained herein has been obtained from sources V-Square believes to be reliable, but the accuracy and completeness of such information is not guaranteed and V-Square shall not be responsible for any inaccuracy, error, or omission from such information.

Indices and trademarks are the property of their respective owners.

All investments involve risk, including potential loss of principal invested. Past performance does not guarantee future performance. Individual client accounts may vary. The strategies and/or investments referenced herein may not be suitable for all investors as the appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. The information provided reflects the views of V-Square as of a particular time and is subject to change at any time without notice.