We create research-informed proprietary strategies in collaboration with academia, data providers and asset owners, and we deliver in rules-based factor investing solutions.

We believe that markets are efficient on average, however there are cycles of inefficiencies.

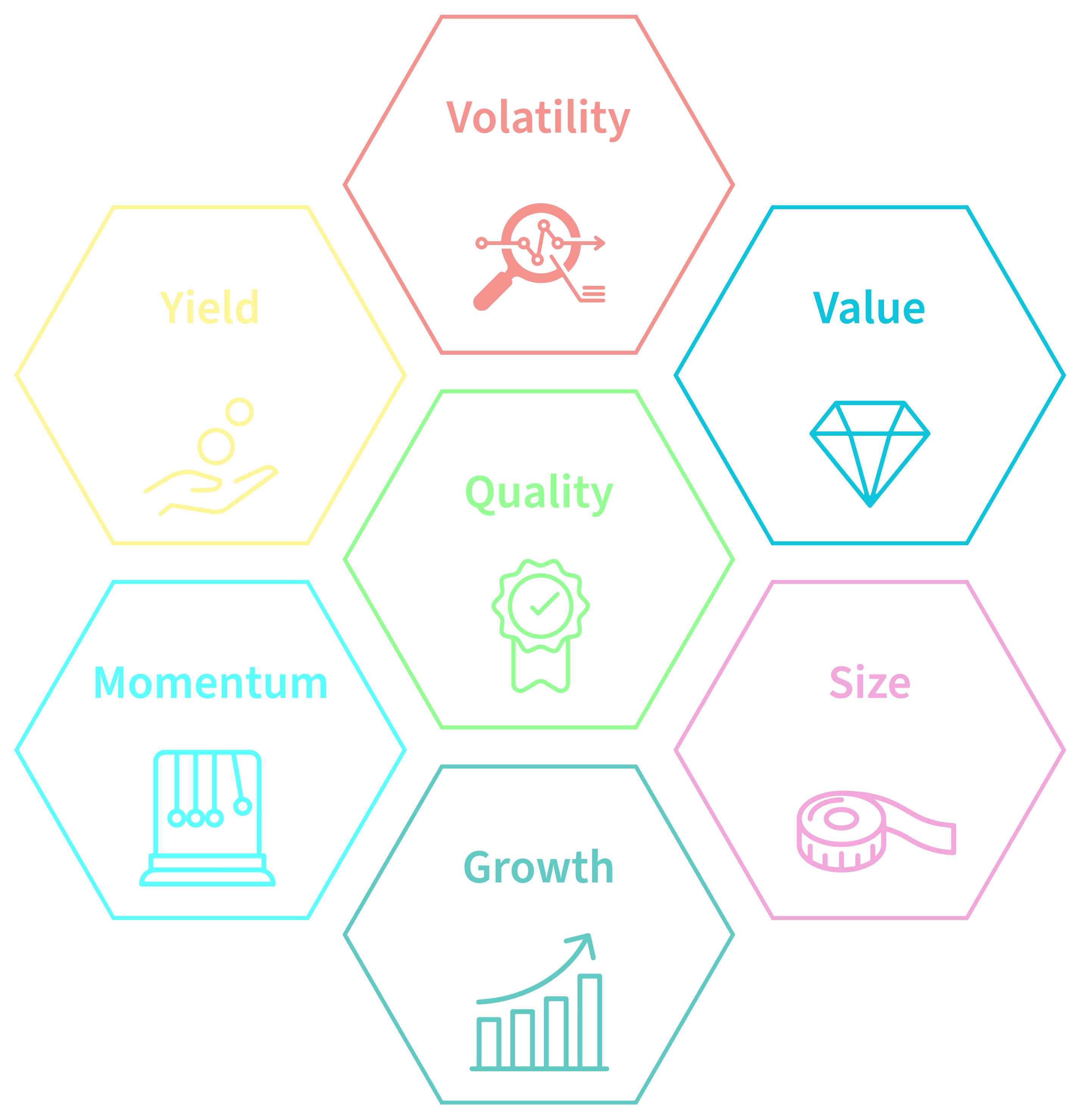

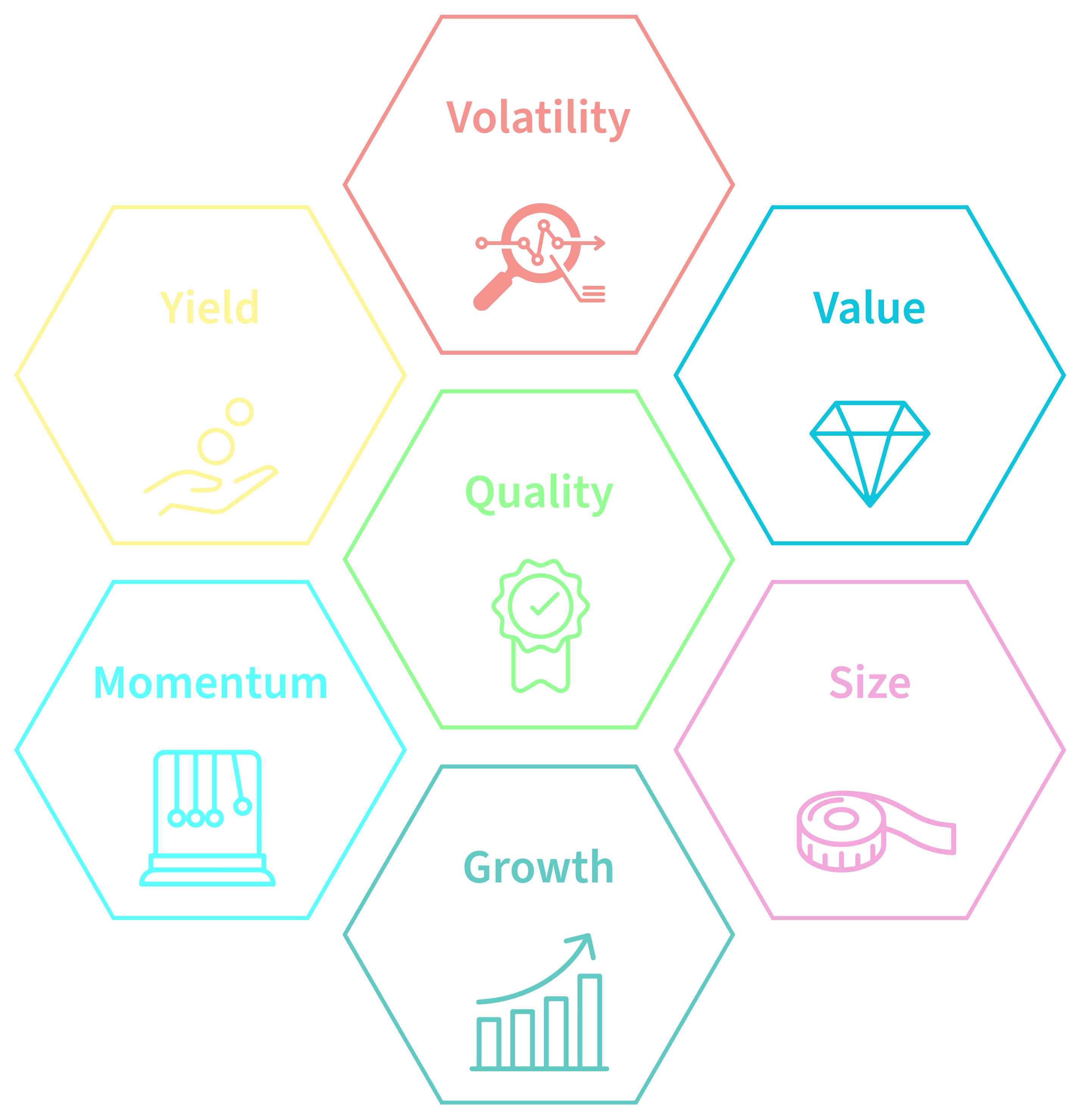

We apply a quantitative approach to help us deconstruct and assess what fundamentally drives investment returns. Factors are sources of risk and premium reward for portfolios.

We construct portfolios focusing on multi-factor risk premia - styles - and aim to deliver consistent returns in rules-based investment strategies.