Why Taxes Matter?

- Investors pay taxes.

- Taxes can represent a large portion of the portfolio performance.

- If not considered or managed properly, taxes can significantly impact portfolio growth.

V-Square's Tax Management Approach

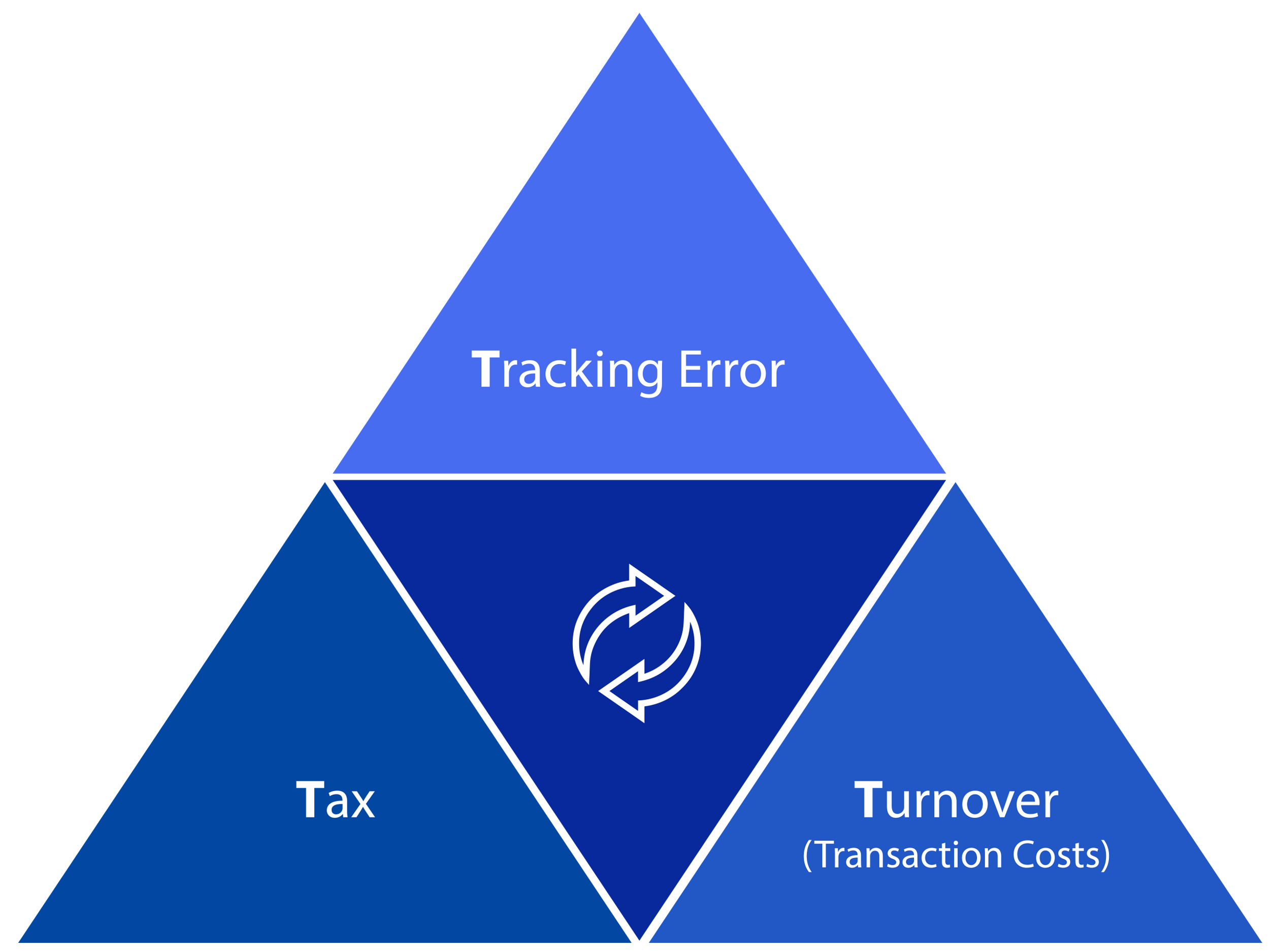

Portfolio managers generally look to solve the investment equation that minimizes the tracking error, the turnover, and the tax bill (the 3T triangle charted below).

V-Square thoughtfully approaches it as an optimization problem as there is a point where the successful decrease of one item in consideration becomes at the expense of the other two items.

We design tax-aware strategies that

- Allow investors to balance taxes, risk-adjusted returns, and transaction costs on a continuous basis

- Enable investors to consider taxes during the portfolio construction process and at the same time keep their portfolios aligned with main objectives.

Risk management is embedded at every step of the process, ensuring adequate and intended exposures to the various risk factors, including ESG risk factors.