Jan 28, 2021

9 minute read

Topic

Thought Leadership

As we embrace the new year following a challenging 2020, the theme of "Building Back Better" remains top of mind. The global pandemic, racial injustice, and natural disasters impacted the lives of many people and took a significant toll on the global economy in 2020. For the economy to Build Back Better, we believe that governments, companies, and individuals must embrace many of the core tenants of Environmental, Social, and Governance (ESG) investing.

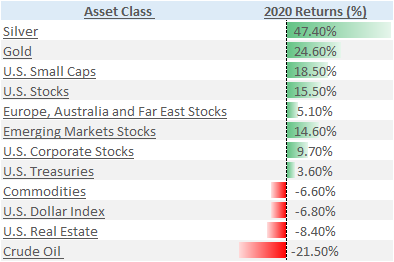

Despite the uncertainty experienced throughout the previous year, it is remarkable that the financial markets have been resilient except for few asset classes (see below).

Source: Bloomberg1

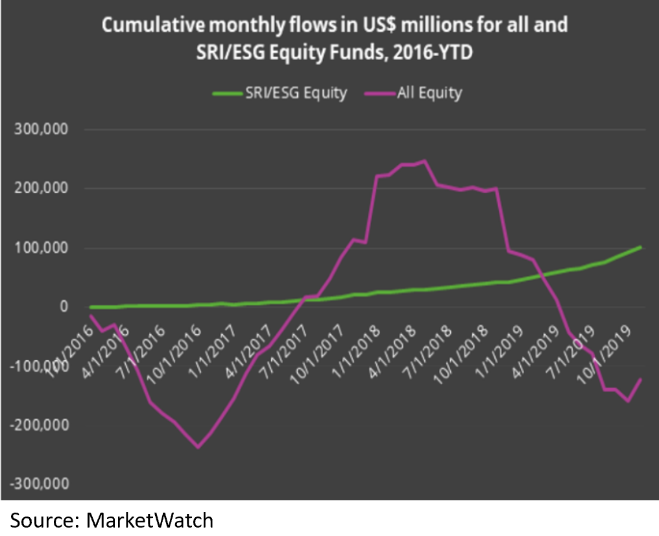

In the asset management industry, monthly flows went through a roller coaster in 2020. There were massive net outflows in the first part of the year, followed by a recovery in the second half of the year, resulting in a $212 billion net inflow for US mutual funds and exchange-traded-funds (ETF); ETFs broke the calendar-year record with inflows of $502 billion2. However, investors remain uncertain about the long-term impact on the global economy, and a significant amount of capital remains on the sidelines.

One bright spot has been investment products that focus on ESG considerations, which saw an unexpected surge of inflows. For example, net inflows to ESG ETFs have more than tripled to $32 billion in the first 11 months of 2020 relative to 2019. This trend is not isolated. According to the Forum for Sustainable and Responsible Investment (US SIF), assets applying ESG data to drive investment decisions account now for 33%, or one in three dollars, of the $51.4 trillion in total U.S. assets under management. Those assets had crossed the $40.5 trillion mark by mid-2020, approximately 45% of the value of global assets4.

More than a mere bubble, we are witnessing a systemic shift of investors' mindsets, agendas, and investing approach.

Considering this backdrop of global disruption yet growth in ESG investment products, here are four ESG trends that we believe will be at the top of investors' agenda in 2021.

1. Climate – From physical risk to portfolio risk.

Climate risk5 refers to the impact that climate change has on the financial performance of a company and the risk-return profile of the securities issued by it. 2020 started with a series of massive bushfires across Australia fueled by record-breaking temperatures and months of severe drought. The cost to the Australian economy was estimated at around $70 billion in January 2020. Similarly, extreme climate-related disasters such as an ever-wild Atlantic hurricane season, flash floods, typhoons, heat waves, earthquakes, volcanic eruptions and wildfires plague communities and businesses from the US to Southeast Asia.

These types of events are occurring more frequently and appear to be taking a greater financial toll on businesses and global economies. As a result, climate risk is being seen more and more as a financial risk in investment portfolios.

As we investigate the components of climate risk, the acute physical risks disproportionately impact industries such as Real Estate, Materials and Consumer Durables and Apparels. When it comes to transition risks, a similar unequal impact is observable with greater risks in the Real Estate, Materials, and Food & Staples industries, while transition opportunities stand out for Technology Hardware & Equipment and Capital Goods. Disregarding climate risk in portfolios equates to underestimating portfolios' total risk. How then can we assess the risk linked to climate change in portfolios?

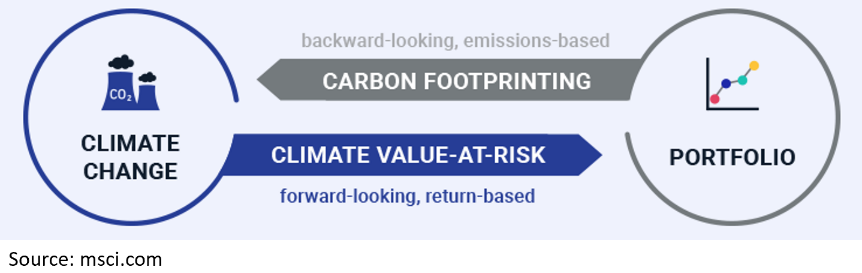

A metric is the Climate Value-at-Risk6 (Climate VaR), which measures in percentage points the potential impact on a security or a portfolio's market value because of the effects of climate change. And research, like the paper Managing Climate Risk in Investment Portfolios published by MSCI in 2020, shows that it is possible to substantially reduce a portfolio's climate risk without significantly altering its risk and return characteristics.

As a result, at the portfolio construction stage, an optimization can now be done along a third dimension: maximize returns while minimizing not only the traditional financial risk, but also climate risk. This creates an opportunity for investors as they can seek to maintain their desired risk/return profile while substantially reducing the often-overlooked climate risk.

On the pure play side, President Biden's $2 trillion climate plan to significantly escalate the use of clean energy, China's Emissions Trading Scheme (ETS) to limit and reduce CO2 emissions in a cost-effective manner, the European Green Deal initiatives, and a wave of commitments by large banks and corporations around the world to achieve carbon-neutrality by 2030 to 2050, are creating investment opportunities while also tackling climate change. Expect more ambitious concerted measures in 2021 with the COP26 (the 26th UN Climate Change Conference of the Parties) scheduled for early November 2021 and the COP15 (the 15th meeting of the Conference of the Parties on the Convention on Biological Diversity) planned for May 2021. We expect clean energy funds and ETFs, and more generally strategies integrating climate risk, to be in high demand.

2. No S without G – From goodwill to incentivization.

Of the 3 letters symbolizing sustainability, the "S" has often been the forgotten child. However, 2020 has been an alarming whistleblower of social inequity and racial injustices. We saw the pandemic disproportionately affect low-income families and communities of color. The death of George Floyd and a tragic series of deaths of unarmed black citizens following encounters with the police sparked weeks of protests in the US and globally, while heightening awareness on issues of racial inequality. The sanitary crisis highlighted the urgent need to confront income inequality.

In order to address the pervasive inequality and injustice, corporations and other organizations are working towards a better "G" in numerous ways. Diversity and inclusion along with unconscious bias training became a priority for companies and organizations. Firms are pledging to implement diversity in leadership roles as well as in the boardroom to show the way. Rather than continuing to rely on goodwill to implement diversity, those issues are being made an integral part of governance metrics, along with board accountability, board responsiveness, director independence, pay policies, risk oversight, etc.

The effort to improve governance is not only driven from within the companies, but it also comes from outside of them. In December 2020, in a push for more diversity, the Nasdaq stock exchange submitted a proposal that would require all of its nearly 3,300 listed companies to include at least one woman plus another director who is either a racial minority or LGBTQ+ on their boards. This will be a listing requirement and companies will have two years to comply. Other organizations, governmental or non-governmental are expected to follow by imposing similar requirements. Companies will be at risk of being delisted, boycotted, or stigmatized if they do not conform.

Investors have a voice in addressing these concerns. For example, human capital is a critical part of a company's operations, and there are many converging collaborative efforts among major groups of influential institutional investors (asset owners and asset managers) to further elevate it as a key component of company performance. For instance, the Human Capital Management Coalition (HCMC) engages companies and other market participants with the aim of understanding and improving how human capital management contributes to the creation of long-term shareholder value. The coalition includes 32 institutional investors representing more than $6 trillion in assets. Employee diversity and inclusion is one of the four fundamental metrics which the HCMC is pushing the U.S. Securities and Exchange Commission (SEC) to require all companies to disclose, along with the number of employees, the total cost of workforce and turnover. Another example is the Embankment Project for Inclusive Capitalism (EPIC), a market-led initiative with 30 organizations representing the entire investment value chain (major asset owners, asset managers, and companies) and almost $30 trillion in assets under management. It focuses on identifying and creating human capital metrics to measure and demonstrate long-term value to financial markets.

The investor case includes that boards, firm leadership, and the workplace should be sufficiently diverse to ensure consideration of a wide range of perspectives, leading to better performance. Social considerations are progressively becoming a matter of good governance and companies are going to be more and more incentivized to show great metrics on the governance pillar to be attractive to investors.

3. Materiality – Why should we care?

As an investment manager, we could look at incorporating all the ESG metrics under the sun and achieve the highest score possible for our portfolios. Then the question is: so, what? Does is help us fulfill our fiduciary responsibilities and achieve better risk-adjusted performance for our clients? If not, the only success we could claim in that case is to have achieved the highest ESG score. However, if our utility function is to maximize performance per unit of risk, then it is probably not the right avenue. Materiality is the answer. In the quest to maximize returns and minimize risk, we must identify and incorporate material ESG considerations, i.e., the ones that we found to have an impact on valuations and a corresponding financial benefit on our portfolios.

When it comes to materiality, the surge of ESG data requires asset managers, asset owners and consultants to become more fluent in ESG lexicon and scoring methodologies. We believe that 2021 could be a turning point in ESG data harmonization, mostly driven by regulations and consolidation of reporting standards.

The main regulations are the following:

- The EU taxonomy, a regulation establishing a general framework for a unified EU classification system, and

- The Sustainable Finance Disclosure Regulation (SFDR), which imposes transparency requirements on asset managers with a view to integrating ESG factors into their risk management and portfolio management processes.

The consolidation of reporting standards is making great strides with the announced proposed merger of the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB7) into a unified organization, the Value Reporting Foundation, to simplify the corporate reporting landscape and system. The merger will fast-track the vision for a comprehensive corporate reporting system championed by the alignment discussions among CDP (formerly the Carbon Disclosure Project), CDSB (Climate Disclosure Standard Board), GRI (Global Reporting Initiative), IIRC and SASB. The materiality map of SASB is increasingly gathering interest from asset owners, chiefly because it links sustainability considerations and valuations.

IFRS is assessing whether it should contribute to the development of ESG disclosure standards. The Big Four US accounting firms published a White Paper in September 2020 under the International Business Council that provides guidelines on metrics and disclosures aimed at harmonizing ESG disclosure.

All this contributes to bringing more access, simplicity, consistency, and standardization to investors. As a result, they will be able to better gauge investment opportunities.

4. ESG Debt – The $11 trillion opportunity.

Despite being the larger asset class, fixed income has remained under-researched from an ESG perspective. The landscape is still dominated by equity investment products.

The assessment of an issuer's creditworthiness initially encompasses the issue's financials and the fixed income products maturity, yield, option-adjusted spread, and place in the issuer's capital structure. However, many investors now understand that ESG analytics can provide a complementary layer of information. This gives them an enhanced ability to correctly price the risk of bonds over longer time periods. Credit rating agencies like Moody's and S&P Global Ratings have been ramping up efforts to use and incorporate ESG principles in their research and ratings, since they are finding that those can have material impact on credit quality.

Corporate bonds analysts have now additional tools to assess the sustainability rating of the issuers and its implication in bond picking and portfolio construction. Emerging Market Debt as a riskier fixed income asset class could also be a fertile ground for future ESG growth. Data suggest that over the long-term, bonds with high ESG ratings outperform those with low ESG ratings or issuers lacking ESG ratings.8

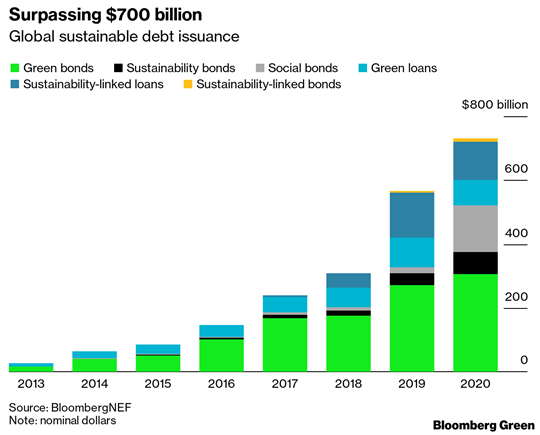

The demand for ESG investments is also driving product innovation. Sustainable debt volume issuance hit a new record of $732.1 billion across the bonds and loans spectrum, with a total cumulative debt around $2.3 trillion at the end of 2020. (See adjacent chart.) ESG debt is well on its way for a third trillion in 2021, and it is poised to balloon to $11 trillion by 20259. Furthermore, policy and regulatory safeguards are being put in place world-wide to alleviate greenwashing concerns.

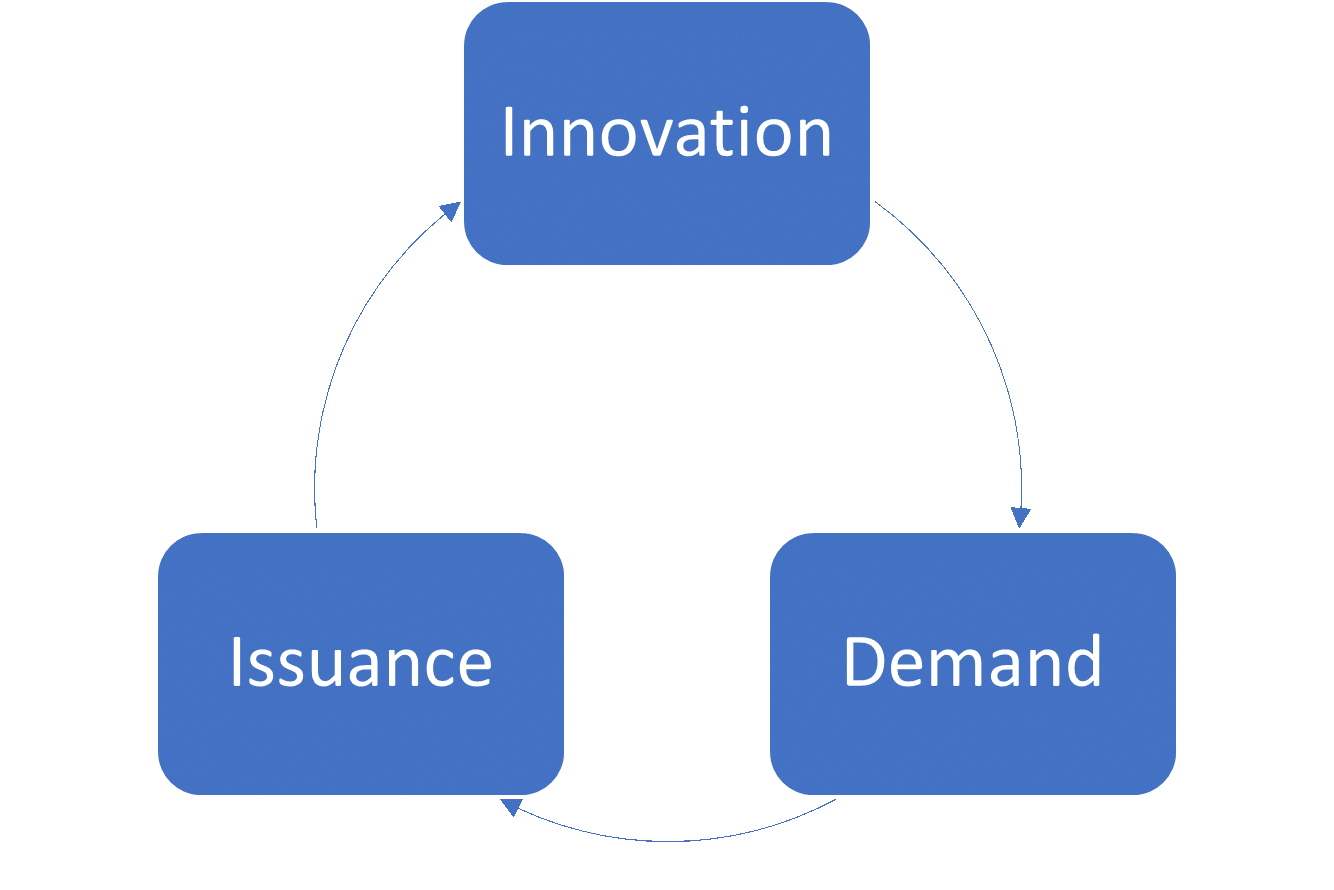

There is ample room for issuance to meet the growing investors' demand. We expect to see more issuance in 2021 due to pandemic relief efforts, governments and corporate commitments to emissions reductions and environmental preservation, and sustained demand. Expanded access, investability and liquidity are propelling the virtuous circle of innovation, demand, and issuance.

As we look forward to 2021, we are excited about the opportunities that it presents while acknowledging the many challenges that remain. As investors of our clients' capital, we believe the trends outlined above will improve the ability to implement ESG factors into our clients' portfolios.

Footnotes

1 Data as of December 31, 2020. Past performance is not indicative of future results. The source for each asset class is set forth in descending order: XAGUSD, XAUUSD, Russell 2000, S&P 500, MSCI EM, Bloomberg Barclays Corporate Bonds Index, MSCI EAFE, iShares Trust US Treasury Bond ETF, S&P/TSX Composite, S&P GSCI, DXY, Dow Jones Real Estate Index, WTI U.S. Oil. See more information in Appendix.

2 Source: Morningstar, Inc.

3 Nasdaq - https://www.nasdaq.com/articles/esg-etfs-punching-above-their-weight-2020-12-09

4 Source: Pensions&Investments

5 Climate risks are typically categorized along two dimensions: transition risk and physical risk. Transition risks are the risks/opportunities associated with transitioning to a low-carbon economy, e.g., shifts in policy, technology or supply and demand in certain sectors. Physical risks are the risks associated with the physical impacts of climate change on a company's operations resulting from, for instance, extreme temperatures, floods, storms, or wildfires.

6 MSCI Climate Value-at-Risk

7 SASB was founded as a non-profit organization with the mission of establishing industry-specific disclosure standards across ESG topics to facilitate communication between companies and investors about financially material, decision-useful information.

8 https://www.msci.com/www/blog-posts/corporate-bond-performance-by/01771274418

9 Source: BloombergNEF

Appendix - Asset Class Description

XAGUSD

Silver Spot price quoted as US Dollars per Troy Ounce.

XAUUSD

Gold Spot price is quoted as US Dollars per Troy Ounce.

Russell 2000

The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization.

S&P 500

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

MSCI EM

The MSCI EM (Emerging Markets) Index is a free-float weighted equity index that captures large and mid-cap representation across Emerging Markets (EM) countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

Bloomberg Barclays Corporate Bonds Index

The Bloomberg Barclays U.S. Corporate Bond Index measures the investment-grade, fixed-rate, taxable corporate bond market.

MSCI EAFE

The MSCI EAFE Index is a free-float weighted equity index. The index was developed with a base value of 100 as of December 31, 1969. The MSCI EAFE region covers DM countries in Europe, Australasia, Israel, and the Far East.

iShares Trust US Treasury Bond ETF

The iShares U.S. Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds.

S&P/TSX Composite

The S&P/Toronto Stock Exchange Composite Index is a capitalization-weighted index designed to measure market activity of stocks listed on the TSX.

S&P GSCI

The S&P GSCI® is widely recognized as a leading measure of general price movements and inflation in the world economy. It provides investors with a reliable and publicly available benchmark for investment performance in the commodity markets.

DXY

The U.S. Dollar Index (USDX) indicates the general int'l value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies.

Dow Jones Real Estate Index

Dow Jones EQUITY REIT Total Return Index. This index is comprised of REITs that directly own all or part of the properties in their portfolios. Dividend payouts have been added to the price changes. The index is quoted in USD.

WTI U.S. Oil

Bloomberg's spot crude oil price indications use benchmark WTI crude at Cushing,OK ; and other U.S. crude oil grades trade on a price spread differential to WTI, Cushing.

DISCLOSURES

© 2021 V-Square Quantitative Management LLC. All rights reserved

This material is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation, or recommendation with respect to any investment service or product provided by V-Square. Furthermore, the information contained here should not be treated as legal, investment, or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific advice from their own professional legal or tax advisors.

Any reference to a specific security, investment, or index is for illustrative purposes only, and it is not intended and should not be interpreted as a recommendation to purchase or sell such security, investment, or index. The trends discussed in this paper should not be considered recommendations for action by investors. They may not be representative of V-Square’s current or future investments.

This information contained herein has been obtained from sources V-Square believes to be reliable, but the accuracy and completeness of such information is not guaranteed and V-Square shall not be responsible for any inaccuracy, error, or omission from such information.

Indices and trademarks are the property of their respective owners.

All investments involve risk, including potential loss of principal invested. Past performance does not guarantee future performance. Individual client accounts may vary. The strategies and/or investments referenced herein may not be suitable for all investors as the appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. The information provided reflects the views of V-Square as of a particular time and is subject to change at any time without notice.