Nov 20, 2020

8 minute read

Topic

New Year

As we closed the book of the past calendar year, committing to New Year’s resolutions finds its roots in religious beliefs and traditions. After indulging in retrospection and reevaluating life choices, some of us take the time to write down new resolutions on a yellow post-it, a brand-new notebook, a self-note email, or just a mental note.

This year, I will exercise at least four times a week, eat healthier food, start my days at 4:30 a.m. with meditation, and improve my chess game ...; oh, and I promise to call my lovely mother at least 3 times a week.

For some of us, the New Year’s resolutions barely make it past February and the routine and habits make us revert to our mean.

This year, I decided to take a different approach to my New Year’s resolutions. Before setting up any aspirational goals, I identified optimizing my life (L) as my utility function; I then ran a full break-down analysis of my time management while finding the best line that fits the relationship between L and some of my dependent variables, in other words the least squares regression line. It sounds like a lot of fun!

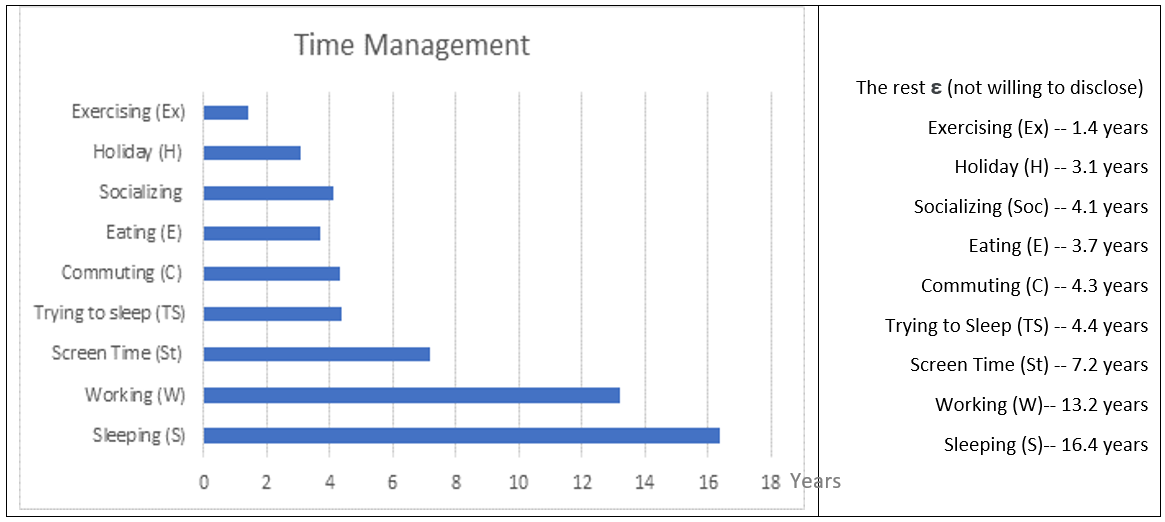

This is what I found as I researched the average breakdown of a 50-year career or 18,262.125 days.

Source: V-Square Quantitative Management

For this exercise, overlapping metrics are not isolated. Let us take a quick mathematic intermezzo to pose the problem. I could abstractly express the time management chart in absolute totals as:

L = W + E + C + S + TS + Ex + Soc + H + ε

However, if I am looking to find the best fitting line over the years, I could look at regressing L (dependent variable) over the independent variables W, E, C, S, TS, Ex, Soc, and H. The general formula would be L=∑iβi × Xi+ ε, or more concretely,

L = βw W + βE E + βC C + βS S + βTS TS + βEx Ex + βSoc Soc + βH H + ε

with ∑iβi = 1.

I kept a printout of my regression line on my desk and committed to make some important changes to my time management this year. To close this brief mathematic parenthesis, it would be interesting to later conduct a large survey and research to understand whether there is a commonality in how the regression line looks like for business leaders we all look up to.

Given the amount of time we spend working in our lifetime, do our aggregated personal resolutions at the corporate level have an impact on the organizations we work at?

I would argue that there is a relationship between our personal resolutions and corporate resolutions set by companies. Maintaining boundaries between our personal life and work life remains critical to improving a better work-life balance, yet our state of mind, physical and emotional well-being, and time management de facto impact our productivity and efficiency as professionals.

Zooming in on W.

As a business leader, I always think about ways to make the organization more efficient. Our edge as a newly formed investment firm is that we have intentionally embedded a set of atemporal corporate resolutions in the fabric of V-Square. Examples of these corporate resolutions include managing wasted time, fast-tracking of innovation, and actively managing talent.

Wasted Time Management.

Having worked for very large organizations prior launching V-Square, I must admit that like most of my peers, I suffered from an Acute Mania For Meetings (AM/FM) and a PowerPoint Syndrome (PPS). The amount of hours spent in internal meetings, follow-ups of internal meetings, follow-ups of follow-ups, and preparing PowerPoint presentations to make a point, all contributed to a tremendous amount and time and resources wasted by investment professionals and corporations.

I made a deliberate decision to reprogram my time management and communication approach. We have capped the number of hours spent weekly on internal team meetings to 10% of our schedules and set up a few hours of open time slots when colleagues can meet to address issues pertaining to the day-to-day operations.

We limit the use of PowerPoint presentations to external presentations and marketing collaterals. The use of professional communication platforms such as Slack and Microsoft Teams, as well as short business memos, are encouraged to manage projects and ongoing business activities. Finally, no updates on agenda items means no need to mobilize partners in bis repetita meetings.

Fast-track innovation.

In one of its industry articles titled “Beyond the Rubicon: Asset Management in an era of unrelenting change”, McKinsey & Company called out the critical role of innovation in asset management: “[…] in a highly competitive environment with more moderate flows, opportunities for outsized growth will more often arise from innovation that creates and captures new pools of assets. McKinsey expects a surge of innovation from leading active managers with up to $8 trillion—up for grabs over the next several years as clients re-examine their core investment beliefs and manager relationships. We are in line with this view as innovation is one the key pillars of our vision.

Our approach to innovation combines embedded investment research with a fast-tracked innovation cycle placing investors' desired risk-adjusted and sustainability outcomes at the heart of what we do. We have developed a streamlined process allowing us to move from strategy ideation to innovation within 45 days. For us, the key part in achieving higher efficiency in product innovation was to use the old Japanese manufacturing system, Kanban , and build a plug-and-play solution platform. This enables us to run a multitude of customized solutions pro-forma, leverage pre-agreed terms with index and data providers and legal and operation set-ups. Fast-tracking innovation creates good habits within organizations and in turn fuels innovation.

Talent Management – From Rookies to MVPs.

In finance and arguably in a lot of other fields, there are no shortcuts or substitutes to experience, expertise, knowledge, and wisdom. Freshly graduated investment professionals are like rookie athletes – they need to learn new skills, hone their craft, learn from peers and clients, go through market cycles, maneuver the corporate world, and the list goes on.

In basketball for instance, in the 75 year history of the National Basketball Association (NBA), Wilt Chamberlain (1960) and Wes Unseld (1969) are the only two players to ever win the Rookie of the Year Award and the Most Valuable Player (MVP) Award in the same year. It is a fascinating statistic given the numerous outstanding athletes who ended up leading franchises, winning titles and accolades throughout their careers and transforming the game of basketball.

However, talented rookies can thrive and garner MVP honors only if their coaches recognize their talents, give them opportunities and playing time by putting them in rotations, and if more experienced peers are not afraid of having “Player-Coach” roles to help the team be more efficient and successful. Our talent management approach appreciates that every career path is a journey and that to succeed, we must all progress together in V-Formation, feeding off each other’s expertise, curiosity, and energy. We created an environment where young professionals cannot be afraid to share their opinions and to make mistakes; learning from them is a formidable teaching method. Our company’s culture built on strong values is striving to attract high caliber investment professionals from around the world, who can embody our PHD values (Passion, Humility and Dedication) to serve our clients and create better value for longer. Becoming our clients’ Most Valuable Partners is the way we define success.

DISCLOSURES

This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security.

The information in this document is provided in good faith without any warranty and is intended for the recipient's background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. V-Square Quantitative Management accepts no responsibility for loss arising from the use of the information contained herein.

© 2020 V-Square Quantitative Management LLC. All rights reserved